Medicare Advantage Agent for Dummies

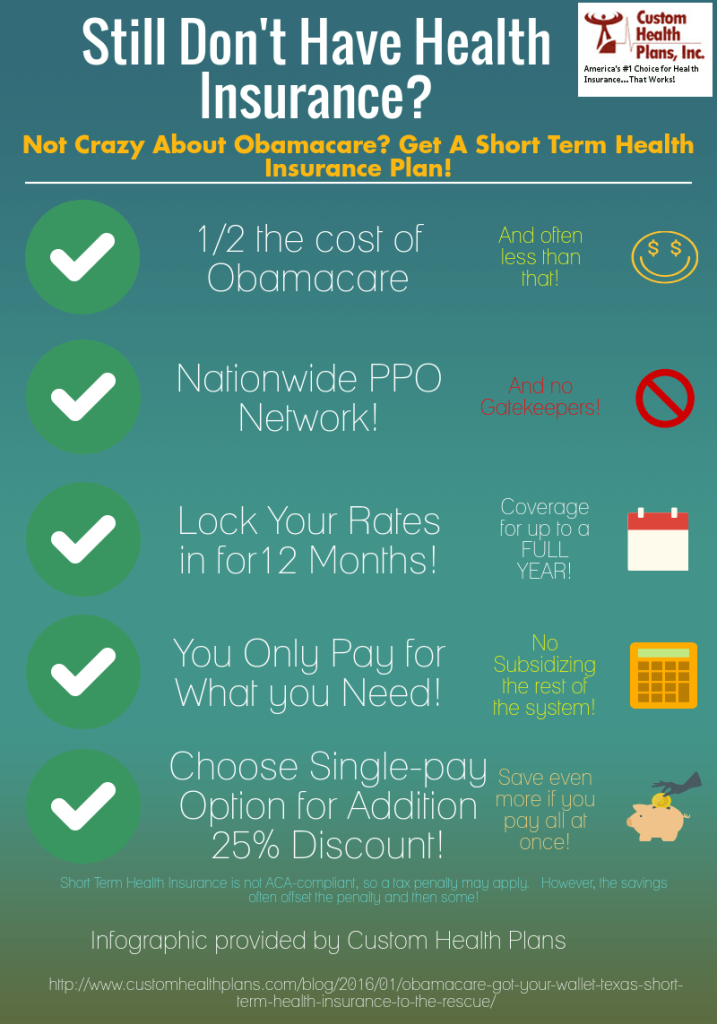

Citizens and plan makers in focus group discussions characterize those without insurance policy as youngsters that have the opportunity to be covered and feel they do not need it (Porter Novelli, 2001). Contrasted to those with a minimum of some private protection, the uninsured are much less likely to report being in exceptional or great health(Firm for Healthcare Research and High Quality, 2001). SOURCE: Center for Cost and Funding Research Studies, Firm for Medical Care Research and Top quality, based upon MEPS information. Youthful grownups in between 19 and 34 are even more most likely to do not have wellness insurance coverage than any kind of various other age. This is chiefly since they are less typically eligible for employment-based insurance coverage because of the nature of their task or their brief tenure in it. The perception that people without insurance coverage have better-than-average health and wellness

adheres to from perplexing the reasonably young age account of the without insurance with the much better health and wellness, usually, of more youthful persons. This covers the link in between health and wellness standing and health and wellness insurance coverage. For those without access to work environment health insurance coverage, inadequate health is a prospective obstacle to buying nongroup protection since such insurance coverage may be highly valued, exclude preexisting conditions, or be simply inaccessible. The number of without insurance Americans is not especially huge and has actually not changed recently. 7 out of ten respondents in a nationally depictive survey thought that fewer Americans did not have medical insurance than actually do(Fronstin, 1998). Approximately half(47 percent )thought that the variety of people without wellness insurance coverage lowered or remained consistent over the latter fifty percent of the last years(Blendon et al., 1999). This drop of nearly 2 million in the variety of individuals 'without insurance coverage (a reduction

of about 4 percent)is absolutely a positive modification. With a softer economic climate in 2000 the current reported gains in insurance protection might not proceed(Fronstin, 2001 ). The decrease in the variety of without insurance will certainly not continue if the economic climate continues to be slow-moving and health and wellness care expenses proceed to surpass rising cost of living. This is due to the fact that the information were collected for a period of strong economic performance. Of the approximated 42 million people who were without insurance, all however regarding 420,000(regarding 1 percent)were under 65 years old, the age at which most Americans become qualified for Medicare; 32 million were grownups in between ages 18 and 65, about 19 percent of all adults in this age team; and 10 million were children under 18 years of age, about 13.9 percent of all children (Mills, 2000). These quotes of the number of persons uninsured are produced from the annual March Supplement to the Current Populace Survey (CPS), conducted by the Census Bureau. Unless otherwise kept in mind, nationwide price quotes of individuals without health insurance coverage and proportions of the populace with various sort of protection are based on the CPS, the most extensively made use of resource click here for more info of price quotes of insurance policy coverage and uninsurance rates. These surveys and the estimates they yield are defined briefly in Table B. 1 in Appendix B - Medicare Advantage Agent. These studies vary in size and sampling methods, the questions that are asked concerning insurance coverage

The Best Strategy To Use For Medicare Advantage Agent

insurance coverage, and the time duration over which insurance protection or uninsurance is measured(Lewis et al., 1998, Fronstin, 2000a ). Still, the CPS is especially valuable since it produces yearly quotes reasonably promptly, reporting the previous year's insurance protection approximates each September, and because it is the basis for a consistent collection of price quotes for greater than two decades, permitting evaluation of fads in coverage gradually.

A Biased View of Medicare Advantage Agent

Over a three-year duration starting early in 1993, 72 million individuals, 29 percent of the united state population, lacked insurance coverage for a minimum of one month. Within a single year(1994), 53 million individuals experienced at least a month without coverage(Bennefield, 1998a). Six out of every ten uninsured grownups are themselves utilized. Although working does boost the possibility that a person and one's relative will have insurance, it is not a guarantee. Also participants of families with 2 full time wage income earners have almost a one-in-ten opportunity of being uninsured (9.1 percent without insurance price)(Hoffman and Pohl, 2000 ). The partnership between wellness insurance policy and accessibility to care is well developed, as documented later in this chapter. The relationship between health and wellness insurance policy and wellness results is neither direct nor simple, a considerable clinical and wellness services research literature links health insurance policy protection

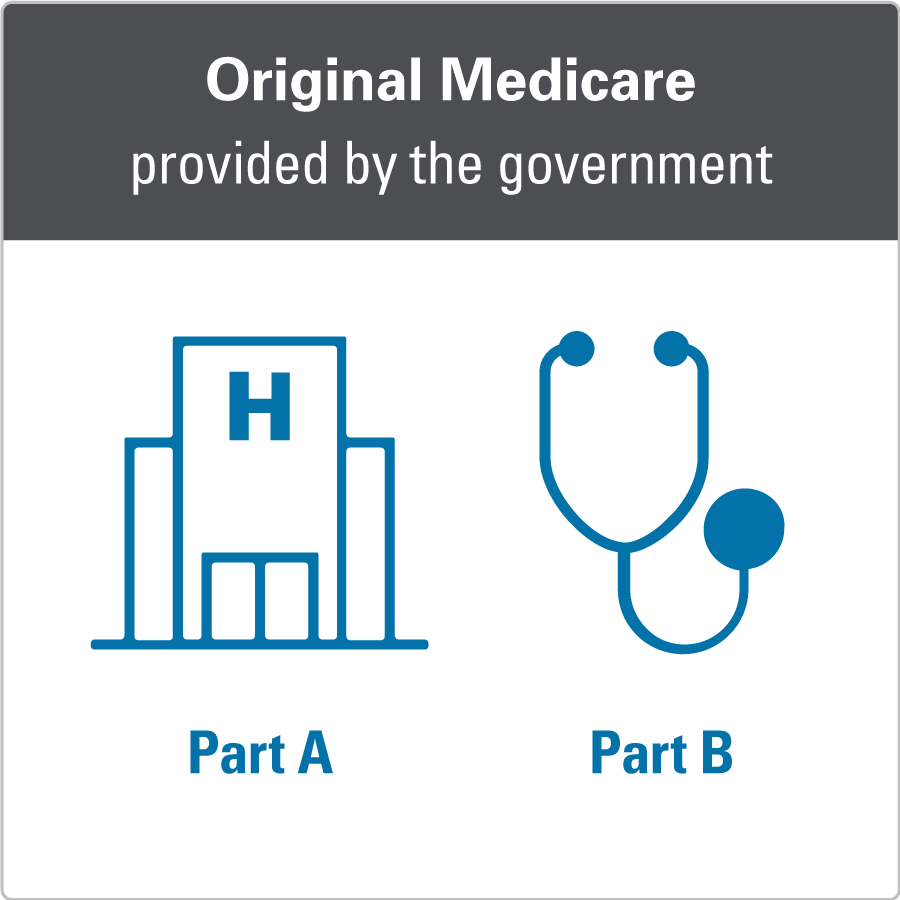

to improved access to care, better quality, and improved personal and population here are the findings populace health and wellnessCondition The 2nd record, on individual health and wellness end results for without insurance grownups, is represented by the innermost circle of the number, while the 3rd report, on family members health, incorporates the topics of the second report but emphasizes a various unit of analysis, particularly, the family. The 6th record in the collection will certainly provide info regarding methods and initiatives undertaken in your area, statewide, or country wide to attend to the lack of insurance and its adverse influences. Levels of analysis for checking out the impacts of uninsurance. This conversation of medical insurance protection concentrates largely on the united state population under age 65 due to the fact that basically all Americans 65 and older have Medicare or various other public protection.

The independent and direct result of health and wellness

insurance helpful resources coverage on access to health health and wellness solutions well establishedDeveloped For still others, health and wellness insurance coverage alone does not ensure invoice of care because of various other nonfinancial barriers, such as a lack of health and wellness care service providers in their area, restricted accessibility to transportation, illiteracy, or etymological and cultural distinctions. A change in insurance policy premium or terms, as well as modifications in revenue, health, marriage condition, terms of employment, or public plans, can set off a loss or gain of wellness insurance coverage.

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)